A food trader walks along Otres Beach in Sihanoukville, which has slowly relinquished its shoreline to development over the years. Yousos Apdoulrashim

Amid illicit activities, haphazard development and abandoned projects, the coastal city of Sihanouk province needs a reset to move forward. A new masterplan might be the answer to shake off its seemingly mucky image to become the Shenzhen of the south

Gun toting, shootouts, police crackdowns on drugs, online gambling and scams, and kidnappings have come to reflect the insidious transformation of a once quiet coastal city of Preah Sihanouk.

Its growth, backed by the boom in the casino and service sector, saw foreign investments funnel into real estate and infrastructure projects, which also caused the surge in Chinese immigrants as Cambodia embraced the Belt and Road Initiative in 2017.

As of June last year, the province boasted 194 projects valued at $30 billion, with an additional $10 billion recorded for tourism and hotel ventures, the municipality announced.

Around 2019, land prices were trending 10 times more at $3,000 per square metre than in 2014, as plots were snapped up for real estate development, such as casinos, resorts and condominiums.

Nearly two-thirds of the 193 registered licences in Cambodia were issued to operators in Preah Sihanouk by the end of December 2019.

According to CBRE Cambodia data for the first half of 2020, 42 were mixed hotel casinos and 40 consisted of standalone casinos in and around the city.

The frenzied pace of construction showcased a mishmash of haphazard development in the city centre, though it served its purpose of meeting the voracious needs of tourists and gamblers alike, who came with money that matched their appetite.

Construction workers on a scaffolding of a builidng in Otres village in December, 2020. Sangeetha Amarthalingam

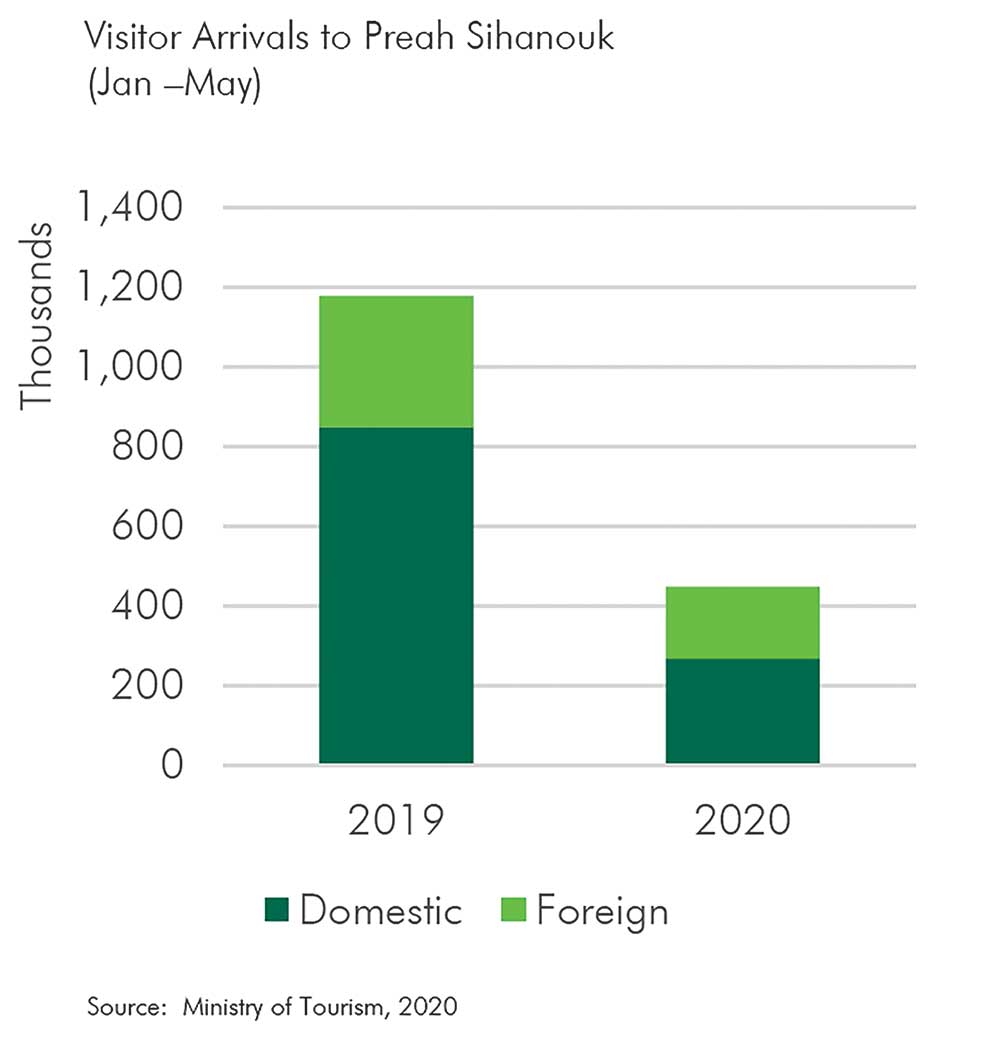

Tourism peaked in 2019 with up to 2.2 million visitors registered in the province, where 60 per cent of them was foreigners.

Then, Sihanoukville was envisioned to mimic the metropolitan Shenzhen city in the southeast of China. In Cambodia, it was the place to grow one’s money, although unsavoury activities defined the underbelly of the expanding town.

Scenes and reports of violent fights and alleged slaying of people on the city streets, apparently linked to the gambling industry, had been documented several times.

On January 1, 2020, an outright online gambling ban was implemented forcing the closure of such operations and the departure of nearly 450,000 Chinese nationals who worked in that segment.

Shortly after, the full impact of the pandemic became apparent as construction projects ground to a halt as key management staff and workers who returned to China for the Lunar New Year celebration could not return to Cambodia.

To date, both events have had a profound impact on Sihanoukville as many project sites remain devoid of activity.

“The pandemic has certainly impacted the real estate market, but Sihanoukville was facing difficulties prior to this,” said James Hodge, managing director of CBRE Cambodia, an affiliate of the US-based real estate network. “Of course, more tourists and easier travel would help to promote more investment, which would likely have meant we would see signs of recovery earlier.”

In mid-2020, CBRE Cambodia found 402 construction cranes present in Sihanoukville. While that number has certainly come down significantly, most of the projects “have been mothballed” in the face of limited end-user demand.

Larger projects have been seen to have sufficient momentum to carry themselves forward, but the bulk of smaller to mid-range projects, priced between $2,500 to $15,000 per square metre, are stalled.

“Predominantly the projects are in shell condition with few showing clear distinction about their intended use or function. Given many are in relatively prominent locations, it can be assumed that a mixture of commercial and residential uses would have been expected,” Hodge told The Post.

As for land prices, he noted, while CBRE has seen instances of reduced rates, most have held up “reasonably well”, although there has not been any price increases so far.

Source: CBRE Cambodia Research, January-May, 2020 (August 2020)

Judging from the current state of affairs in the real estate sector, would it be safe to construe it as a side effect of the gambling boom?

Hodge replied that Sihanoukville “always held enormous potential”, and this was spotted by many during the previous wave of development.

However, a major source of fuel for the city’s real estate boom was withdrawn when the online gaming ban was enacted, and this quickly tipped the real estate market into a state of oversupply.

“I believe it would have been very difficult to assess the sustainability of the real estate market’s growth prior to this action, but clearly the impact has been significant.

“As we look to the future, it is clear that finding a more sustainable, diversified growth path with the longevity to create real change for Sihanoukville and it’s people will be a top priority,” he said.

`Cannot just be about casinos’

In the past few weeks, long-held suspicions of the continuity of illegal activities were confirmed by gaming industry experts as the authorities mounted raids on nondescript buildings, which allegedly housed online gambling activities.

In one incident, an exchange of fire ensued between several foreign nationals and the police, followed by arrests of tens of Chinese nationals and confiscation of firearms, computers and other equipment.

The raid also showed that the online gambling ban inadvertently pushed the activity underground along with other illegal operations, which over time invoked fear in locals living in the city.

With all that has been going on, the coastal city is in need of an overhaul.

A decade has passed since one of the first few plans to develop Sihanoukville was drawn up. One of them was a joint study titled National Integrated Strategy of Coastal Area and Master Plan of Sihanoukville which was conducted by the Ministry of Land Management, Urban Planning and Construction, and Japan International Cooperation Agency. It is not certain what came of it as ministry officials did not respond to questions.

However, in 2016, China offered to help shape Sihanoukville into Shenzhen, China’s own Silicon Valley but the plan did not take off then either.

Only now, the government is putting a foot forward to embark on the feasibility and design of the project, known as the Sihanoukville Multipurpose Special Economic Zone (SEZ) Masterplan, which is expected to start in two months.

A sub-decree mapping out its code of conduct was signed by Prime Minister Hun Sen in June this year.

The Ministry of Economy and Finance (MEF) with the support of a Shenzhen consulting firm will spend 18 to 24 months to come up with study that is aimed at cleaning up Sihanoukville’s somewhat mucky past.

In February 2020, MEF permanent secretary of state Vongsey Vissoth contended that Sihanoukville had problems related to construction and real estate, saying it was a “bubble” having grown too fast on the back of the gambling sector.

Vissoth was quoted by an English daily as saying that the transformation into Shenzhen “cannot just be about casinos”, adding that it would be “an industrial city with services, technology and tourism”.

The masterplan, which covers a 2,500 square kilometre radius, is aimed at attracting high-income tourists as well as investors by turning the old city into a financial city with luxury and leisure accommodations bearing the “smart, green and livable city” concept.

It is understood that the plan might include a logistics hub, export processing zone, bonded warehouse and free trade zone, which the ministry is certain it would ultimately raise the image of Sihanoukville.

At the same time, the creation of jobs and a sustainable tax revenue are in the offing as the masterplan is realised in five years or so once it is implemented.

When asked if the plan can place Sihanoukville back on a growth path to become the next Shenzhen given its present image, CBRE’s Hodge said he was not sure if one was on the right track to talk about the transformation.

He felt that the economic and geographic context of Sihanoukville and Shenzhen are “very different”, however, the latter offers an “exemplary model” of how to develop a modern, high-functioning urban environment that delivers economic growth and opportunity for many while acting as a magnet for top talent.

“I believe that the progress made in connecting Sihanoukville with the region and the rest of the country, the strides made in [combining] a competitive regulatory framework for the province [as well as] the clear planning that highlight the province as a location for a diverse range of business, will mean it is well placed for the future,” he added.

Kim Heang, regional operating principal of Keller Williams Cambodia and CEO of Khmer Real Estate Co Ltd, acknowledged that gaming is “one big part” of Chinese investments into real estate in Sihanoukville.

However, the coastal city is also known for its leisure tourism, residential accommodation, seaport and SEZs.

“Actually, the multipurpose SEZ plan is the original masterplan for Sihanoukville, although gaming was too strong for us to [start] talking about [a way forward],” said Heang, who holds a Ph.D in real estate studies.

Indeed, tax revenue from the gambling sector was a boon in the past. In 2019, nearly $85 million in tax revenue was posted by the General Department of Taxation, one third of it from online gambling, said Ros Phearun, MEF deputy director for financial industry.

Following the ban and the coronavirus blight, tax revenue fell more than half to $40 million in 2020.

In the first half this year, the ministry recorded a 90 per cent year-on-year drop as casinos stayed shut in the face of the pandemic, Phearuntold The Post late August.

Yet, Sihanoukville maintains its allure, thanks to its location on the southwest coast of the country.

It is also home to the one of three international airports in the country, and Cambodia’s only deepsea port, Sihanoukville Autonomous Port, which handles 80 per cent of the nation’s exports annually.

For the seaport, things are looking up after a slight setback last year. Net profit rose 69 per cent year-on-year to $3.5 million in its second quarter ended June 30, 2021 because of increased cargo and container throughput, and a drop in operating expenses and unrealised foreign exchange loss.Revenue went up 14 per cent to $21 million for the same period.

Apart from the port, the province houses about 10 SEZs with the Chinese-majority owned Sihanoukville SEZ being the largest. By 2023, improvement in shipments is expected following the completion of the $2 billion Sihanoukville-Phnom Penh expressway, which is being constructed by China Road & Bridge Corp, a China state-owned entity.

In the real estate sector, Hodge found that the path forward for Sihanoukville has “only become clearer”, as the infrastructure upgrades have paved the way for the province’s multipurpose SEZ status and new projects.

“The Covid-19 pandemic has meant that while the real estate market itself has remained subdued, the supporting structures needed to generate optimism for the future have strengthened,” he said, when comparing CBRE’s latest findings with last year’s market performance.

With the masterplan, the narrative on Sihanoukville is changing with a focus on industries, a financial centre and leisure, rather than rely on casinos alone, a notion shared by Vissoth last year.

The industrial capacity of the province has always been at or close to the forefront of the agenda, Hodge opined, but it was somewhat drowned by the scale and pace of the casino sector’s growth.

“Ultimately, both sectors have their place in the province’s future, albeit in different formats. We are likely to see a significant increase in the quality of casino resort projects, as well as a range of supporting industries growing up around these more sustainable projects.

“Meanwhile, we think that the groundwork is now in place for the province’s industrial sector to start to be become noticed, perhaps even on a regional level,” he commented.

For the plan to be realised, the government will engage in public and private partnerships in order secure financing that is expected to run into billions of dollars.

`They are not everything’

Moving on, Hodge said Sihanoukville’s infrastructure and competitive regulatory environment meant that it is now “well positioned” to capitalise on the next phase of growth for Cambodia.

He believed that growth is likely to look “very different” to what was seen between 2016 and 2019, with significantly more emphasis placed upon manufacturing and logistics, as well as creating high-quality urban environments, with a diverse hospitality sector acting as a significant pillar.

“A strong catalyst would be the selection of Sihanoukville as a manufacturing or logistics hub for a significant business or industry, as perhaps would the development of high-quality, regionally significant tourist attractions,” he said.

Separately, Heang admitted that the soft global travel industry and China’s restriction on overseas travel could damper the prospects for real estate growth in Sihanoukville.

But, he pointed out, the Chinese market “is not everything” for Sihanoukville, although it is a significant player in the province.

He indicated that the slow improvement in the Chinese travel secor was not a bad thing. “Not [just for] Sihanoukville or Cambodia but the world as [everyone] needs to be safe from Covid-19, if not, it would be recognised as the third World War.”

Hodge agreed that the Covid-19 pandemic is a “significant” disruptor to the real estate industry and will likely continue to have a depressing effect on Sihanoukville’s real estate sector for some time.

“However, the impact of the pandemic is being felt differently across different industries – for instance, while hospitality development is likely to remain subdued, the logistics and manufacturing segment will likely take off at an earlier stage,” he said.